Guotai Junan Securities (Vietnam) released its financial statements for the first quarter of 2022, marking record-high revenue and profit after tax compared to the same period of the year. The Company reported positive revenue from financial advisory, which contributes 8% to the quarter’s total revenue.

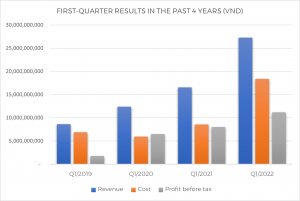

Guotai Junan (Vietnam) has announced its first-quarter 2022 results ended March 31, 2021. Accordingly, the Company’s revenue increased by 65% compared to the same period last year (“YoY”) to VND 27.2 billion, and profit after tax increased by 40% to VND 11.2 billion, marking the highest increase ever over the same period.

In particular, the company’s stock brokerage division increased by 97% YoY, exceeding VND 11 billion (of which Q1/2021 revenue increased by 27%), serving as the main growth driver. Driven by the market boom and the increase in the number of customer transactions, income from margin lending and advance activities increased by 52% to VND 10.8 billion, a historical high.

Mr. Hoang Anh, General Director of Guotai Junan (Vietnam), said: “In the first quarter of 2022, Guotai Junan (Vietnam) ‘s revenue and profit after tax reached a historical high. In the first three months of the year, stock brokerage activities continued to attract high-quality clients and the quality of brokerage continued to improve, thus becoming one of the main growth drivers in the Company’s business”. Sharing about the orientation in the coming time, General Director Hoang Anh said that the Company will continue to expand its business areas and strengthen the synergy between stock brokerage, margin lending and underwriting, to provide individual customers and organizations with information about quality investment and financial channels.

Operating Revenue Highlights:

Operating expenses in the period

During this period, the Company’s total expenses increased by 114.82% YoY to VND 18.4 billion, mainly due to increases in brokerage operating costs and commission management costs.

Investment Banking Sector

After being supplement licensed to the securities issuance guarantee business, Investment Banking activities have been strongly focused on the development and initially recognized positive contributions to the company’s business situation.

In 2021, the Investment Banking Department has signed and is conducting consultancy on issuing individual corporate bonds, serving as a service to issuers to a large corporate client; and serving as a Bond Distribution Agent for some other reputable partners in the market. Consulting revenue was recorded in the first quarter of 2022.

Divestment consultancy contracts for the State Capital Investment Corporation (SCIC) are still implemented in accordance with the law, ensuring the highest interests of the State. In addition, the Company has also conducted contact, and negotiations and proceeded to sign many other consulting contracts with potential customers such as listing registration, IPO, securities offering, etc.

Xuan Huy

10 /04

2024

02 /02

2024