Techcom Bond Fund (TCBF)

Managed by Techcom Capital, distributed by Guotai Junan (Vietnam) Securities

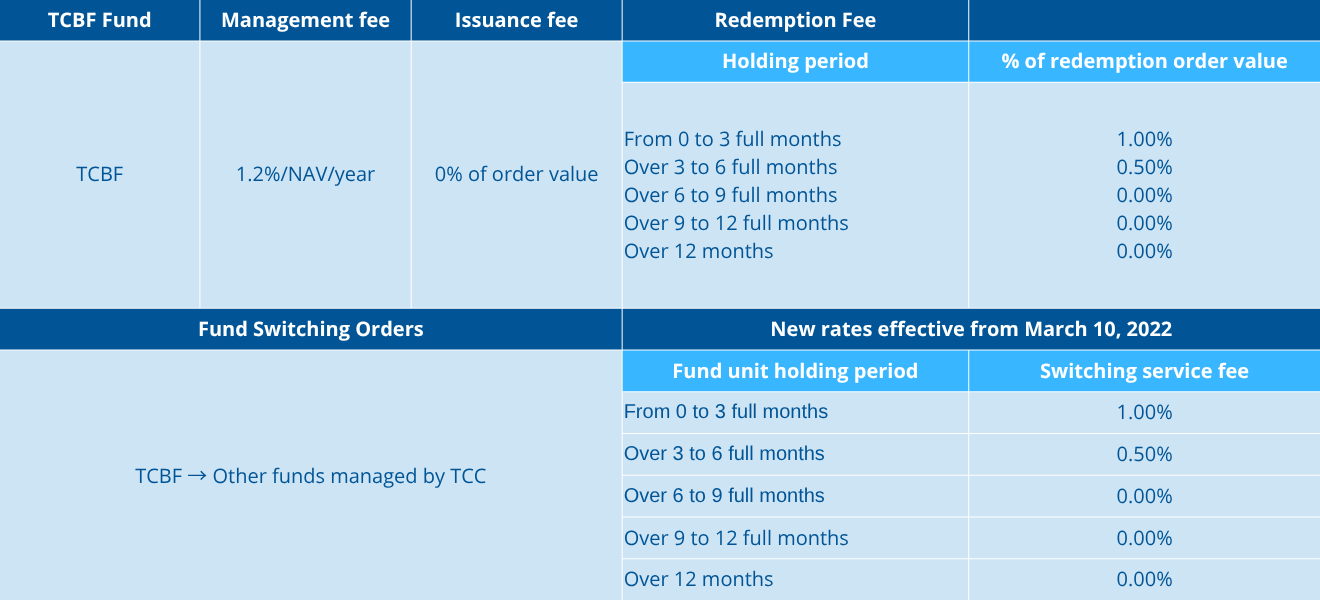

TCBF offers individual investors the opportunity to invest alongside Techcom Capital in high-quality corporate bonds, certificates of deposit, and treasury bills – some of the most trusted fixed-income instruments on the market. The fund aims to generate long-term, stable income, with expected returns that outperform the average 12-month savings deposit rate, depending on the investment period.

|

More Efficient No extensive experience required, saving investors both time and effort. The fund targets expected returns higher than the average 12-month savings deposit rate, with actual returns realized based on the investment duration. |

Invest Anytime, Anywhere Enjoy a seamless investment experience with a secure, high-tech platform, fully online, and anytime. Start investing with as little as VND 10,000. |

|

Daily Liquidity Flexible daily redemption available. |

Greater Peace of Mind The fund is managed by a team of seasoned professionals and features a well-diversified portfolio of top-tier bonds. Backed by a disciplined investment process, it offers a sustainable solution for long-term financial planning. |

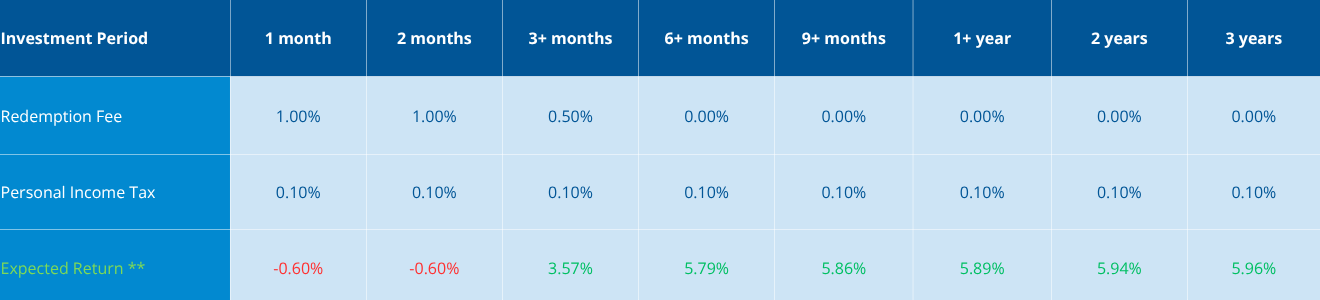

Projected Returns(*) Over Time for New TCBF Investors

Assuming a target return of 6% per annum (which is 1–2% higher than the average 12-month savings deposit rate), the projected returns for investors are as follows:

(*) The projected return is based on the estimated yield of the Fund’s current portfolio and does not represent a guaranteed future rate of return. Mutual fund certificates are investment products that carry risk. Please refer to the Risk Disclosure provided by TCBS when placing fund subscription orders.

(**) The 1-month return is not annualized. An investor’s actual return is calculated based on the difference in NAV per fund unit (NAV/Unit) between the time of purchase and redemption, after deducting personal income tax and redemption fees (if any). We recommend investors hold their fund units for more than 12 months to be eligible for redemption fee waivers.

The trading price of fund certificates (NAV/Unit) may fluctuate depending on market conditions, and investors may incur losses on their invested capital.

Fund Representative Board

Fund Documents

1. Fund Charter

2. Fund Prospectus