Revenue generated in the second quarter of 2022 helps Guotai Junan Securities (Vietnam) erase all accumulated losses, and turn a new phase with a profit surplus, despite the gloomy market performance with low liquidity and sharply reduced index.

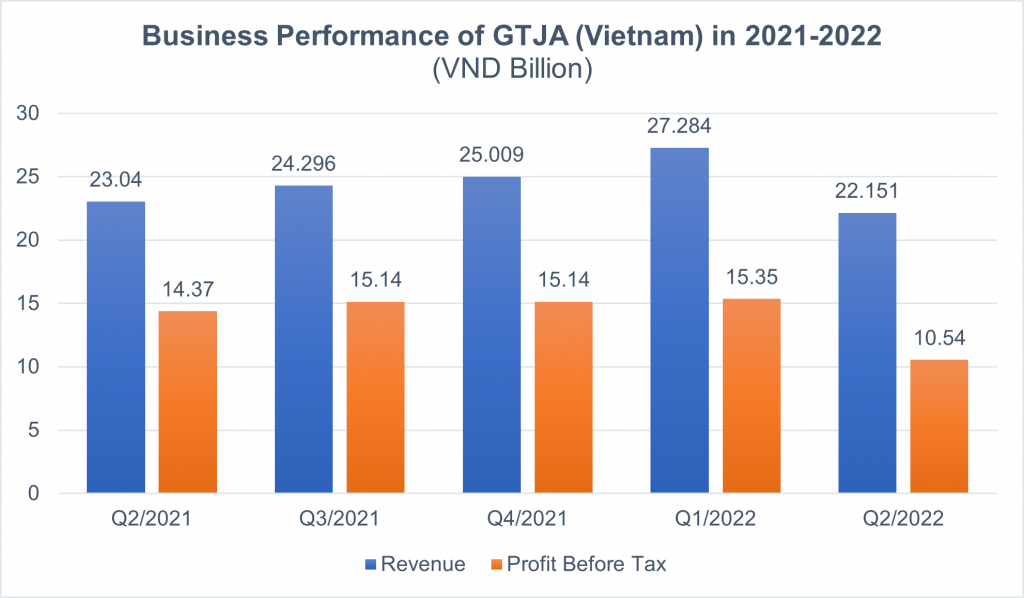

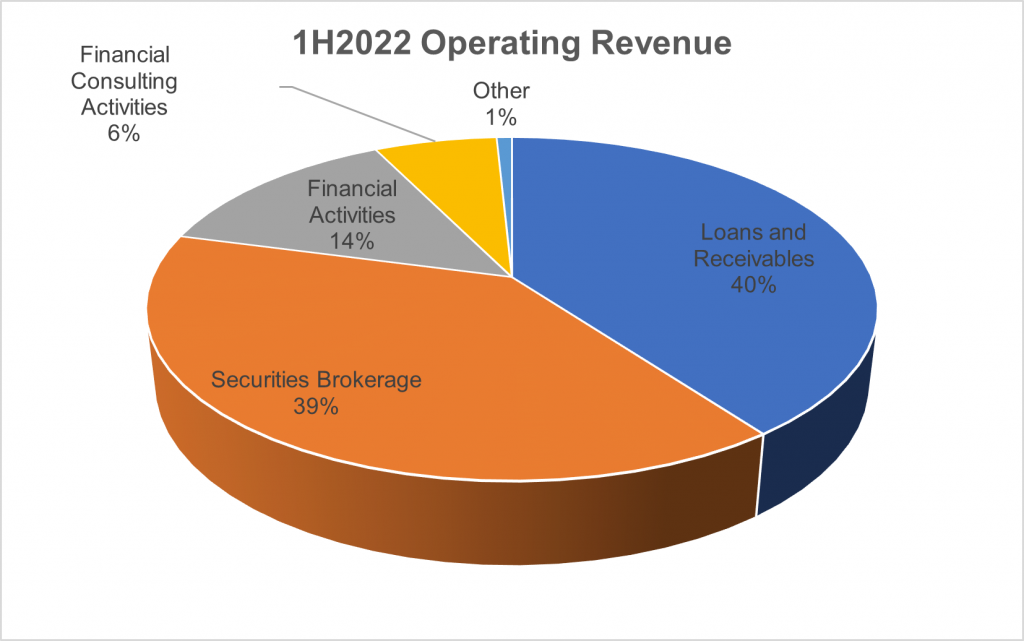

Guotai Junan Securities (Vietnam) – GTJA (Vietnam), stock code IVS, recorded revenue in the second quarter of 2022 of more than VND 22 billion, and profit before tax of more than VND 8.2 billion, according to recently published financial statements. Results from securities brokerage and margin lending contributed 77% of total revenue.

In the first half of 2022, GTJA (Vietnam) recorded more than VND 49 billion in revenue, up 25% over the same period. Margin lending continues to be the highest revenue contributor with more than VND 19 billion revenue, up 11% compared to the number implemented in the first half of 2021. Also according to the audited semi-annual financial statement, the company’s operating results reached more than VND 19 billion in the first 6 months of 2022, down slightly by 2% over the same period, amid a sharp decline in the stock market and the majority of securities companies recorded backward profits.

At the end of the first 6 months of 2022, the market capitalization decreased by more than VND 1.22 million billion. Recorded at the end of June, the VN-Index lost 1,200 points to 1,197.6; the P/E ratio is only 13 times, much lower than the 10-year average of 15 times.

End accumulated losses and put stocks out of warning status

With the above financial data, the company has completely ended the accumulated loss and brought the undistributed profit after tax to a positive figure. IVS stock code is expected to be taken out of the warning status by the Hanoi Stock Exchange (HNX), according to the provisions of Point b, Clause 4, Article 37 of the Regulation on Listing and Trading of Listed Securities. This will help GTJA (Vietnam) to strengthen its financial health, meet the requirements of business expansion and improve its reputation in the market.

IVS stock code will soon be allowed to lend margin loans

On the shareholder side, GTJA (Vietnam)’s erase of accumulated losses will simultaneously end the thirst for margin lending for IVS shares in recent years. IVS stock code is forecasted to soon meet the conditions for margin loans at securities companies. The financial structure of GTJA (Vietnam) after being reviewed is considered safe and positive with a debt-to-equity ratio (D/E) of only 0.01, equity accounting for 98.82% of asset value. This will be an indicator of the company’s growing strength soon, the clearest evidence of strong business capacity, and less financial pressure from liabilities.

GTJA (Vietnam) has turned a new phase with the accumulation of surplus profits, the companionship of shareholders and customers is the strong motivation of the company to dominate market share in Vietnam. The company will continue to improve its governance system, strengthen risk management and compliance, ensure financial security, maintain stable operations, and establish a sustainable development strategy, especially focusing on recruiting high-quality talent to constantly improve competitiveness.

____

07 /08

2025