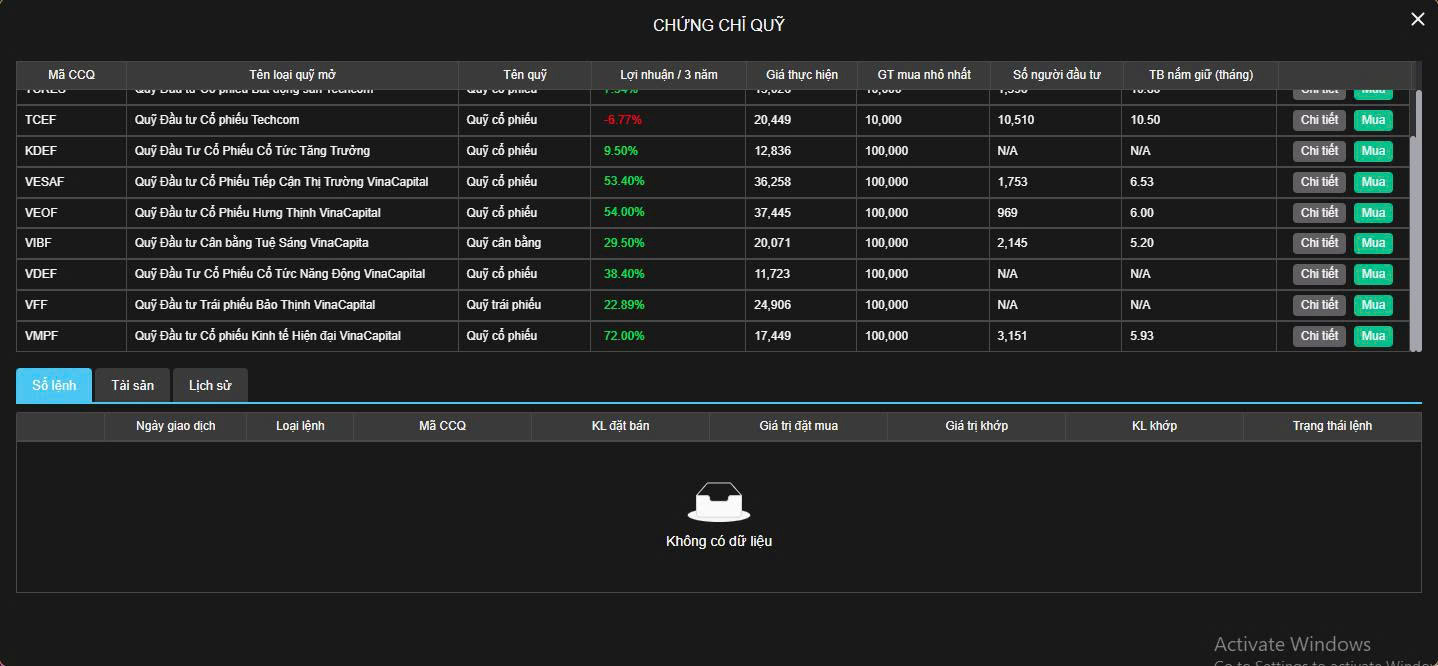

Fundmart – Open-ended Mutual Funds

Fundmart is an investment solution featuring open-ended funds managed by experienced professionals. With a minimum investment of just VND 10,000, iFund makes professional investment products easily accessible to everyone.

Fundmart offers a diverse product portfolio tailored to different financial goals and risk appetites. Online transactions via Fundmart by GTJA Vietnam enable investors to manage their portfolios with ease and efficiency.

Invest in Open-ended Funds

Gain easy access to the stock market with professionally managed portfolios that balance safety and flexibility.

|

Techcom Bond Fund (TCBF) TCBF offers individual investors the opportunity to invest alongside Techcom Capital in high-quality corporate bonds, certificates of deposit, and treasury bills. The fund aims to generate long-term, stable income with expected returns higher than the average 12-month savings deposit rate, with actual returns received based on the investment duration. |

Techcom Equity Fund (TCEF) TCEF enables investors to own shares in leading publicly listed companies on the Vietnamese stock market, targeting long-term returns projected to be twice the average 12-month savings deposit rate, with actual returns realized based on the investment duration. As an equity fund, TCEF carries a high level of risk, as its returns may fluctuate significantly year to year, depending on movements in the stock market, the Vietnamese economy, and global economic conditions. |

Techcom Flexible Balanced Fund (TCFF) TCFF primarily invests in securities—including equities and bonds—of industry-leading companies or those with strong long-term growth potential. The fund also targets assets with attractive valuations or high, stable yields, aiming to deliver long-term returns projected at 1.5 times the average 12-month savings deposit rate, with actual returns realized over the investment period. TCFF carries a moderate level of risk. |

|

Techcom Banking & Financial Equity Fund (TCFIN) TCFIN enables investors to own shares in leading companies operating in the banking and financial services sector on the Vietnamese stock exchange. The fund targets long-term returns projected at twice the average 12-month savings deposit rate, with actual returns realized based on the investment duration. This sector plays a critical role in Vietnam’s economic development, with listed companies in banking and finance accounting for nearly 40% of the total market capitalization of the VN-Index. |

Techcom Real Estate Equity Fund (TCRES) TCRES allows investors to own shares in leading companies operating in the real estate and building materials sectors listed on the Vietnamese stock market. The fund targets long-term returns projected at twice the average 12-month savings deposit rate, with actual returns realized based on the investment period. Real estate, construction, and building materials are key sectors of the Vietnamese economy, with strong long-term growth potential supported by solid fundamentals: |

Techcom Small & Mid-Cap Equity Fund (TCSME) TCSME enables investors to own shares in leading small-cap and mid-cap companies listed on the Vietnamese stock market. The fund aims to deliver long-term returns projected at twice the average 12-month savings deposit rate, with actual returns realized based on the investment duration. This group of stocks typically features companies with moderate market capitalizations—some of which are market leaders in niche sectors or possess distinct competitive advantages. These characteristics offer the potential for higher growth compared to large-cap (bluechip) stocks, but also come with greater short-term price volatility. As such, investing in this segment requires professional fund management to carefully balance risk and return, optimizing long-term value for investors. |

|

KIM Dividend Growth Equity Fund (KDEF) KDEF is the first open-ended equity fund managed by KIM Vietnam and distributed by Guotai Junan (Vietnam) Securities. The fund aims to achieve medium- to long-term net asset growth through both capital appreciation and dividend income. KDEF focuses on companies that offer attractive dividend yields along with strong long-term growth potential, providing a balanced approach between income and capital gains for investors. |